Insta Jumbo Loan FC Eligibility: A Comprehensive Guide

Insta Jumbo Loan FC eligibility is a crucial topic for those looking to secure large-scale financing for their homes. In today's competitive housing market, understanding the intricacies of jumbo loans can be the key to unlocking your dream property. This article will delve into the specifics of Insta Jumbo Loan FC eligibility, outlining the requirements, benefits, and potential pitfalls associated with jumbo loans.

Jumbo loans differ from conventional loans primarily in their loan limits and underwriting criteria. For many homebuyers, especially in high-cost areas, jumbo loans serve as a vital financial tool that allows them to purchase properties that exceed the limits set by traditional lenders. However, navigating the eligibility criteria can be daunting without the right information.

In this comprehensive guide, we will explore the eligibility requirements for Insta Jumbo Loans offered by financial institutions, discuss the application process, and provide insights into how to improve your chances of approval. Whether you are a first-time homebuyer or looking to refinance, this article aims to equip you with the knowledge needed to make informed financial decisions.

Table of Contents

- What is a Jumbo Loan?

- Benefits of Jumbo Loans

- Insta Jumbo Loan FC Eligibility Requirements

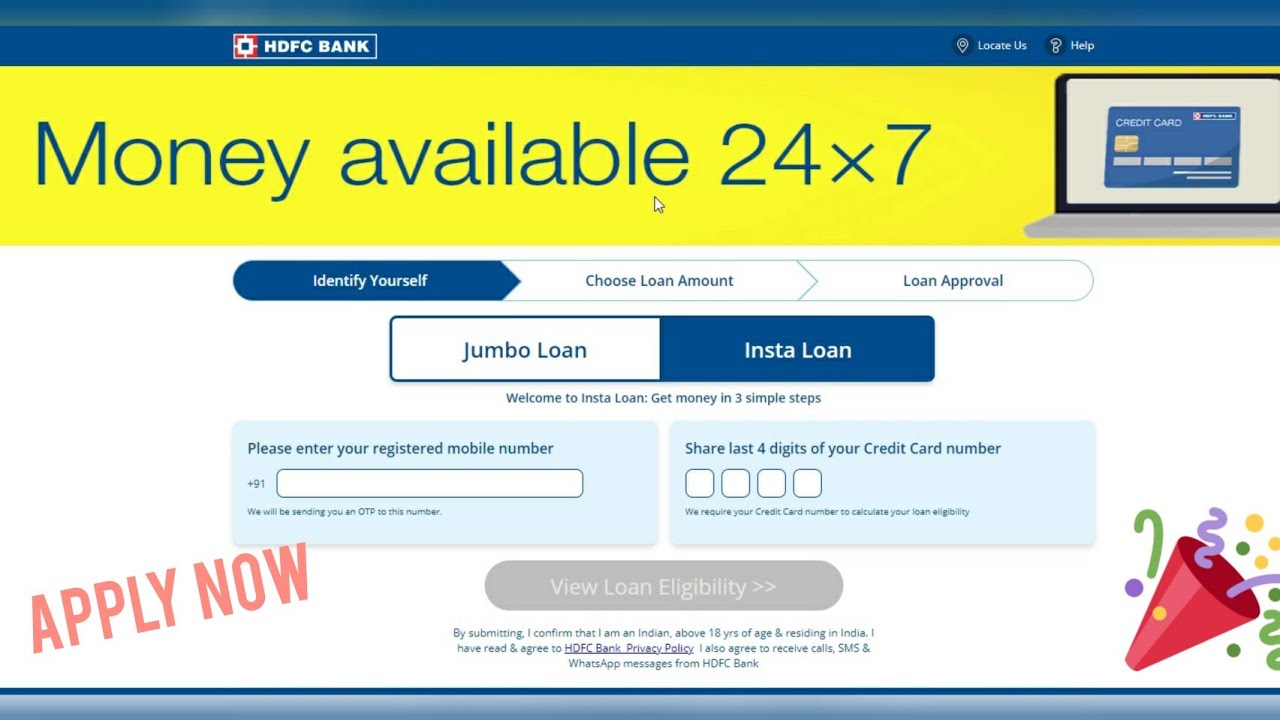

- Application Process for Insta Jumbo Loans

- Improving Your Eligibility for Jumbo Loans

- Common Mistakes to Avoid

- Conclusion

- Frequently Asked Questions

What is a Jumbo Loan?

A jumbo loan is a type of mortgage that exceeds the conforming loan limits set by the Federal Housing Finance Agency (FHFA). These limits vary by location, but as of 2023, the baseline conforming loan limit for a single-family home is $726,200 in most areas of the United States. In high-cost areas, this limit can be significantly higher.

Because jumbo loans are not backed by government-sponsored entities like Fannie Mae or Freddie Mac, they typically come with stricter underwriting requirements. This includes higher credit scores, larger down payments, and more thorough documentation of income and assets.

Benefits of Jumbo Loans

- Higher Loan Amounts: Jumbo loans allow you to borrow more money than conventional loans, making it easier to purchase higher-priced homes.

- Competitive Interest Rates: While jumbo loans typically have slightly higher interest rates than conventional loans, many lenders offer competitive rates, especially for borrowers with excellent credit.

- Flexible Financing Options: Jumbo loans can be used for various purposes, including purchasing primary residences, vacation homes, and investment properties.

- No Private Mortgage Insurance (PMI): Many jumbo loans do not require PMI, which can save you money on your monthly payments.

Insta Jumbo Loan FC Eligibility Requirements

To qualify for an Insta Jumbo Loan, borrowers must meet specific eligibility criteria, which include:

1. Credit Score

Most lenders require a minimum credit score of 700 for jumbo loan approval. However, higher scores can improve your chances and may result in better loan terms.

2. Down Payment

Jumbo loans usually require a down payment of at least 20%, though some lenders may accept lower down payments for borrowers with excellent credit. A larger down payment can also lower your interest rate.

3. Debt-to-Income Ratio

Your debt-to-income (DTI) ratio is a critical factor in determining your eligibility. Most lenders prefer a DTI ratio of 43% or lower, though some may allow up to 50% for high-income borrowers.

4. Documentation

Borrowers should be prepared to provide comprehensive documentation, including:

- Recent pay stubs

- Tax returns for the past two years

- Bank statements

- Proof of additional assets, such as investment accounts

Application Process for Insta Jumbo Loans

The application process for Insta Jumbo Loans typically involves several steps:

- Pre-Approval: Start by getting pre-approved for a jumbo loan, which will give you an estimate of how much you can borrow and help you understand the interest rates you may qualify for.

- Choose a Lender: Research and compare lenders to find the best terms and rates. Look for lenders with experience in jumbo loans.

- Complete the Application: Fill out the application form, providing all necessary documentation and information.

- Loan Processing: The lender will verify your information and assess your eligibility.

- Underwriting: An underwriter will evaluate your application and determine if you meet the eligibility criteria.

- Closing: If approved, you will proceed to the closing stage, where you will sign the final paperwork and receive your funds.

Improving Your Eligibility for Jumbo Loans

Improving your chances of getting approved for an Insta Jumbo Loan can be accomplished through several strategies:

- Improve your credit score by paying down debts and making timely payments.

- Save for a larger down payment to demonstrate financial stability.

- Reduce your DTI ratio by paying off outstanding debts.

- Provide thorough documentation to showcase your income and assets.

Common Mistakes to Avoid

When applying for an Insta Jumbo Loan, be mindful of these common pitfalls:

- Not understanding the difference between jumbo and conventional loans.

- Failing to shop around for the best rates and terms.

- Overlooking the importance of pre-approval.

- Neglecting to maintain a budget that accommodates mortgage payments.

Conclusion

Insta Jumbo Loan FC eligibility can seem complex, but understanding the requirements and the application process is crucial for prospective borrowers. By being aware of the benefits of jumbo loans, improving your financial standing, and avoiding common mistakes, you can position yourself for successful home financing.

We encourage you to leave a comment below with any questions or share your experiences with jumbo loans. Additionally, feel free to explore our other articles for more insights on home financing and real estate.

Frequently Asked Questions

1. What is the minimum credit score required for an Insta Jumbo Loan?

Most lenders require a minimum credit score of 700.

2. Can I get a jumbo loan with a lower down payment?

While a 20% down payment is typical, some lenders may accept lower amounts for borrowers with strong credit histories.

3. Are jumbo loans more difficult to obtain than conventional loans?

Yes, jumbo loans often come with stricter eligibility requirements due to the higher loan amounts.

4. Do I need to pay PMI on a jumbo loan?

Many jumbo loans do not require private mortgage insurance (PMI), which can save you money.

Article Recommendations

- Who Isavid Cha Wife

- How Old Were The Cast Of Cheers

- Papoose New Girlfriend

- David Bromstad Twin Brother

- Ge Clooney Children

- Alex Lagina And Miriam Amirault Wedding

- Subhashree Sahu All Seasons Mms

- 5 2024 Kannada

- Bunniemmiex

- Nancy Mace Military Service